Investment Operations Specialist

What is an Investment Operations Specialist?

An Investment Operations Specialist is responsible for the management of workflow throughout all departments within a business. Operations specialists ensure the smooth and efficient daily operations of a company. The operations specialist's responsibilities may vary depending on the sector but generally include overseeing employees in their daily duties, optimizing processes and procedures to achieve maximum efficiency, and ensuring deliverables are met.

A successful Investment Operations Consultant will have worked with and/or in the following areas of any investment management firm:

Client Billing

Investment Operations

Portfolio Accounting - Custodian and Vendor management

Performance Reporting - Composites, Client reporting etc.

Trading - Trade confirmation and settlement process

Reconciliation - Reconciliation of investment accounts and transactions

Firm-wide Reporting - Performance, Assets Under Management, etc

Marketing Distribution, Client Statements, Marketing Materials

Compliance Monitoring and Regulatory Requirements - SEC 13f reporting

New Account Processing

GIPS Standards

Investment Operations Specialist Responsibilities

Business operations involve the daily activities of a company that keep it functional and financially successful. Some organizations hire business operations specialists to identify areas for improvement, provide guidance and implement changes that can raise productivity and increase profits.

The responsibilities of an Investement Operations Consultant can vary, based on considerations such as their role within the organization, the type of company they work for and their employers' expectations and plans. However, common responsibilities for a business operations specialist include:

Develop and implement department-wide quality control measures

Recommend new procedures for increasing the efficiency of day-to-day operations

Maintain communication with operations manager, staff members, and vendors to ensure adherence to protocols across key touch points

Assist the operations manager in developing, planning, and coordinating operational activities

Oversee investment management practices and improve them when necessary

Ensure that operations are in compliance with various regulatory bodies

Investment Operations Due Diligence & Risk Management

Operational Due Diligence is a bespoke, continuous and iterative process of formulating and testing the investment thesis, in order to co-create an actionable value creation plan. Operational Due Diligence, which leads to Risk Management, is primarily forward looking and opportunity focused.

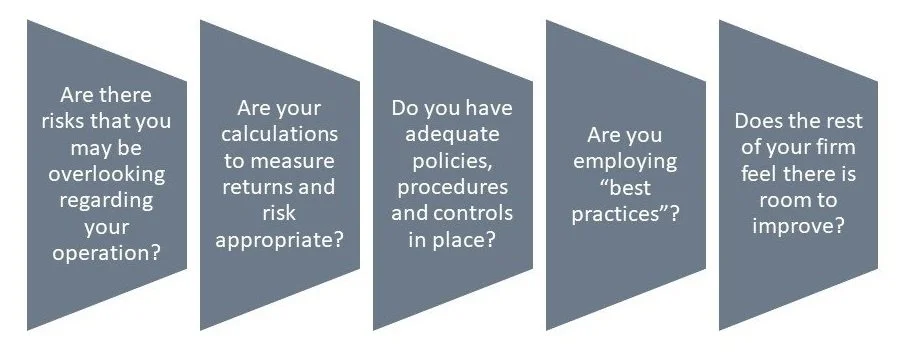

Is Your Firm Operationally Efficient?

Investment Operations Specialist Services

Let’s face it, when it comes to long-term, organizational-related projects, it is hard enough for employees to do their regular daily functions, let alone take on other projects. Additionally, sometimes a Firm just needs to have a ‘fresh set of eyes’ to take a look at their Firm, from an outsider’s perspective. Some firms are looking just to possibly simply their back office architecture or performance a complete front to back office transformation.

In working with firms in various capacities as an Investment Operations Consultant, I have developed a Checklist of items to review when it comes to examining a firm’s operational processes. No one can reduce operational risk to zero, but at the same time, we can help to identify and prevent or diminish a large portion of operational risks. Firms are different, and departments are organized differently, and serve different needs.

Thus, there isn’t a “cookie cutter” approach to our service, though our reviews generally follow a fairly consistent approach. Some Investment Operations Consulting services are provided as follows:

Organizational structure

Outlining your organizational structure is key. This includes information on your employees, their roles, and how they're structured within the company. This is important for understanding who is responsible for what within your business.

Application Processes

Analysis of business applications that the firm uses, and determine ownership for each application. This will help with making a diagram of who utilizes each system, for what purpose(s), along with identifying the ‘whens, whys and for whoms’. This helps to determine inefficiencies and bottlenecks, and to generate standardized business practices.

Getting into the nitty-gritty of how your business actually works. Describing your business processes, from start to finish. This includes everything from how you run your firm to how you deliver data to your clients.

Future State Wish List

It is important for a Firm to determine 1) what capabilities its systems currently have as well as 2) identify what the Firm actually wants out of its systems. Performing this GAP analysis is an essential function. Many firms create ‘manual workarounds’ in the moment, but then never to take a step back and develop a longer-term overall process going forward.

Checklists & Procedures

It is important to identify all Procedures and Checklists each employee uses at the Firm. This will help to identify all functions, and look for overlap, redundancies, etc. Checklists and Procedures are essential in the efficient management of all your firm’s operational processes.

Control Job/Overnight Processes

A crucial step in any assessment is determining what Nightly Automatic Processes are run, in what order, at what time, and what criteria are included in each job. It only takes one job to ‘bomb’ to muck up the whole works. Typically, firms have processes that are ‘running in the background’ that are no longer needed ot utilized.

Project Support

I can serve as the primary contact for user support issues; assist with managing outsourced vendors, and own/manage specific projects an/or larger firm initiatives such as legacy system conversions and data migrations. Having a dedicated person to keep the ball moving forward is crucial.

Back/Middle Office Support

Learn to manage your Back/Middle office more efficiently which includes overall improved operational processes. Continually updating operational workflows ensures more efficient organizational operations. Even though these processes are ‘fixed costs’ to your business, attempting to lower these costs is always a worthwhile exercise.

As an Investment Operations Consultant, I have created a list with on/around 150 items have been cataloged thus far. With each firm that engaged, historical knowledge of these firms is saved for future engagements. Therefore, each firm that is engaged benefits from the historical knowledge of each prior engagement. Ask me about it!

Sample Client Engagements

Firm B’s existing Operations Manager of 20 years was about to retire. Firm B was looking for a suitable replacement for the retiring Operations Manager, but could not find the right fit. Firm B had an employee ‘in the wings’, but felt that he/she wasn’t entirely ready for a managerial role, because he/she didn’t have enough industry or managerial experience. Therefore, I was hired to a) become the interim Operations Manager, while b) revamping many of the outdated Operational processes, while c) updating the capabilities of existing systems, and d) educate & groom the existing employee for ascension into the managerial position. Firm B realized that many of the processes they were performing were outdated in nature, and just needed someone to ‘jump in’, roll their sleeves up, and make change happen.

Assets Under Management: $5B

Account Types: Brokerage accounts, wrap programs, mutual funds and institutional managed accounts

Accounts Under Management: 4500+

Investment Vehicles: Options, US Equities, ETFs, mutual funds and Fixed income

Major Hurdle: Educating existing, long-term employees on new system ehancements to their legacy system

A US-based investment management firm engaged with me to a) determine if a conversion off of their existing portfolio accounting system was needed and b) revamp their outdated Operational processes while c) acting as the interim Operations Manager in order to d) groom an existing employee to eventually take over the role. All 4 points of the project scope occurred simultaneously over the course of a 1 year time period.

Assets Under Management: $6B

Account Types: Brokerage accounts, wrap programs, mutual funds and institutionally managed accounts

Accounts Under Management: 3500+

Investment Vehicles: All

Major Hurdle: Attempting to increase operational efficiencies in a custom-build portfolio accounting system

Case Studies

T + 1 Settlement

What does T + 1 settlement mean for your firm?

Job Description

Sample Operations Specialist job description defined