GIPS Composite Report

A GIPS Composite Report (GIPS report) is defined as a presentation for a composite that contains all the information required by the GIPS standards and may also include recommended information and supplemental information. The GIPS Report may also include other information that the firm believes would be helpful to interpreting the report. The GIPS Composite Report must be one that represents the strategy being marketed to the prospective client, of which, there are three types of GIPS Reports – GIPS Composite Reports, GIPS Pooled Fund Reports, and GIPS Asset Owner Reports.

What Does a GIPS Report Contain?

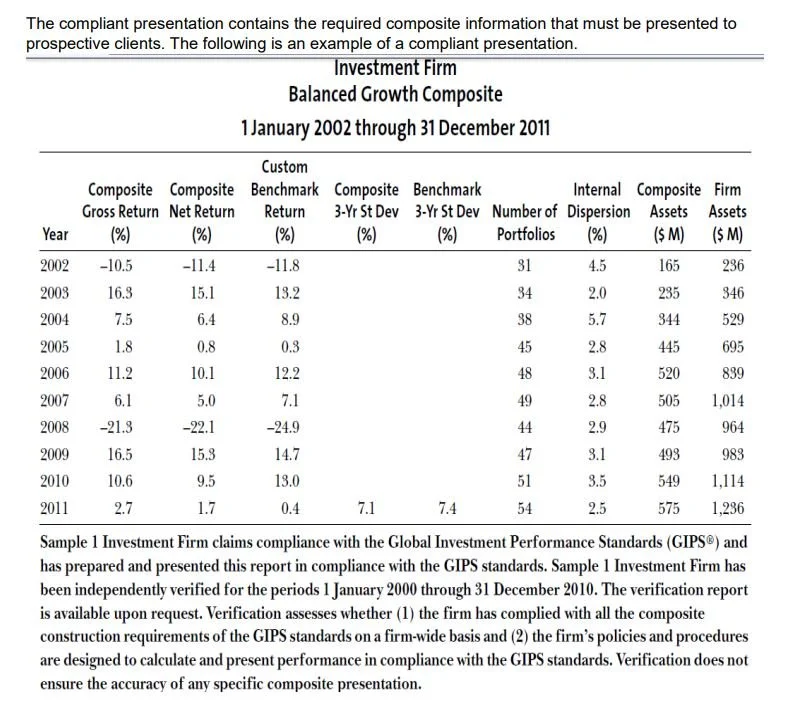

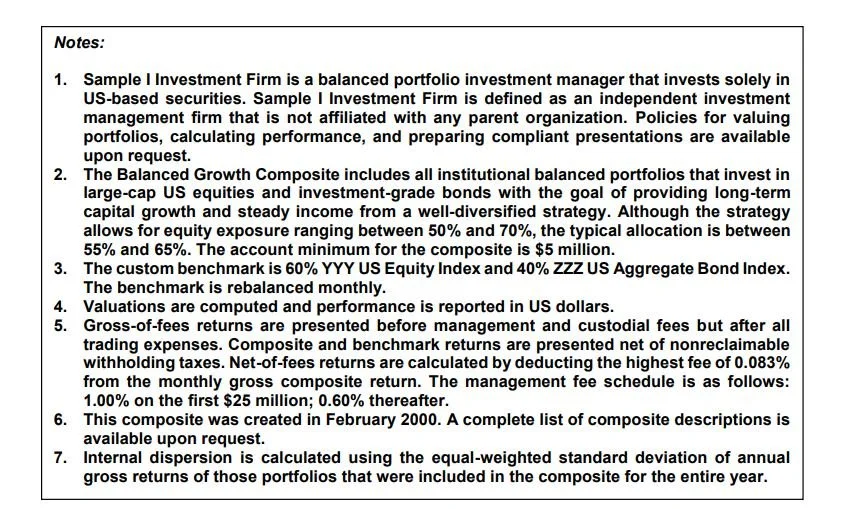

In addition to portfolio and composite returns, additional statistics required for each annual period include total return of the composite’s benchmark, number of portfolios in the composite at period-end, composite assets at period-end, total firm assets or composite assets as a percentage of the total firm assets at period-end, an internal dispersion measure of individual portfolio returns, and three-year annualized ex post standard deviation, using monthly returns, for both the composite and the benchmark, for periods ending on or after 1 January 2011.

Below is an illustration of a sample GIPS composite report, as well as an additional link:

GIPS Calculation Methodology

Although the GIPS standards allow flexibility in return calculation, the GIPS return must be calculated using a methodology that incorporates the time-weighted rate of return concept for all portfolios, except for private equity. The GIPS standards require a time-weighted rate of return because it removes the effects of external cash flows, which are generally client-driven. Therefore, a time-weighted rate of return best reflects the firm’s ability to manage the GIPS portfolios according to a specified mandate, objective, or strategy, and is the basis for the comparability of composite returns among GIPS firms on a global basis.

The CFA Institute has developed a Guidance Statement on the princples of how to calculateGIPS performance returns.

GIPS Report Updating Requirements

There are countless website links devoted to creating the GIPS Report, essential disclosures, etc (GIPS Report example). However, what most of these sites' illustrations do not specify is 'how' the firm creates its formalized process around disseminating the newly created GIPS Report.

GIPS Requirement 1.a.11 - GIPS Prospective Client

The firm must make every reasonable effort to provide a GIPS Composite Report to all prospective clients when they initially become prospective clients. The firm must not choose to which prospective clients it presents a GIPS Composite Report.

GIPS Requirement 1.a.12 - GIPS Report Updates

Once the firm has provided a GIPS Composite Report to a prospective client, the firm must provide an updated GIPS Composite Report at least once every 12 months if the prospective client is still a prospective client.

GIPS Requirement 1.a.16 - GIPS Report Updates

When providing GIPS Reports to prospective clients and prospective investors, the firm must update these reports to include information through the most recent annual period end within 12 months of that annual period end.

GIPS Requirement 1.a.17 - GIPS Report Reasonable Effort

The firm must be able to demonstrate how it made every reasonable effort to provide a GIPS Composite Report to those prospective clients required to receive a GIPS Composite Report.

GIPS Requirement 1.a.24 - GIPS List of Composite Descriptions

The firm must provide a GIPS Composite Report for any composite listed on the firm’s list of composite descriptions to any prospective client that makes such a request.

The entire GIPS compliance effort is focused around providing the GIPS Report to GIPS Prospective Clients. With the adoption of the GIPS 2020 rules, an expansion was made regarding the documentation as to how a firm actually provides the GIPS report to the Prospective Clients, tracks them, etc.

*Information is created from a variety/multiple sources of CFA Institute materials.